Private banking

A strong foundation

Relying on its 25 years of professional experience, Concorde Group offers private banking services to affluent clients who wish to follow an essentially conservative investment strategy and are ready to assume moderate risks.

Robust growth

As a consequence of the dynamic growth in recent years, our private banking portfolio reached HUF 210 billion by the end of 2019. Our 900 private banking clients are served by nine highly qualified private bankers, each having several years or decades of professional experience. To ensure maximum availability, each of our private bankers serves a limited number of clients.

Our goal is to grow wealth at a rate above inflation

We follow an absolute return strategy in our investments. Our goal is to achieve an above inflation growth rate for the wealth of our clients, regardless of the current market environment. We actively manage our clients’ portfolios, adapting flexibly to changing capital market conditions.

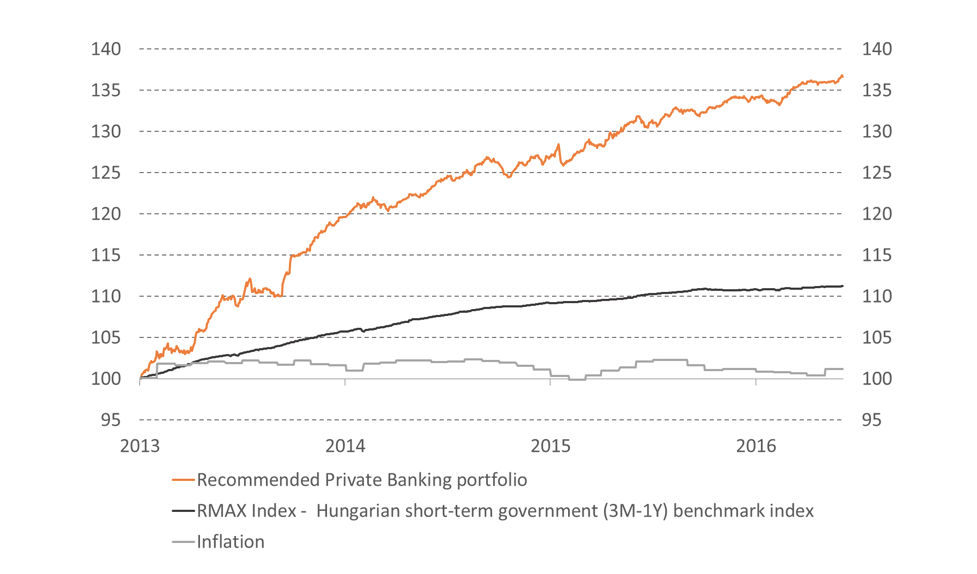

Past performance – high above the inflation rate

1. Performance of the recommended private banking portfolio

(compared to inflation and returns realised on short-term government securities)

Our recommended private banking portfolio outperformed the price level change and the returns realised on risk-free, liquid investments.

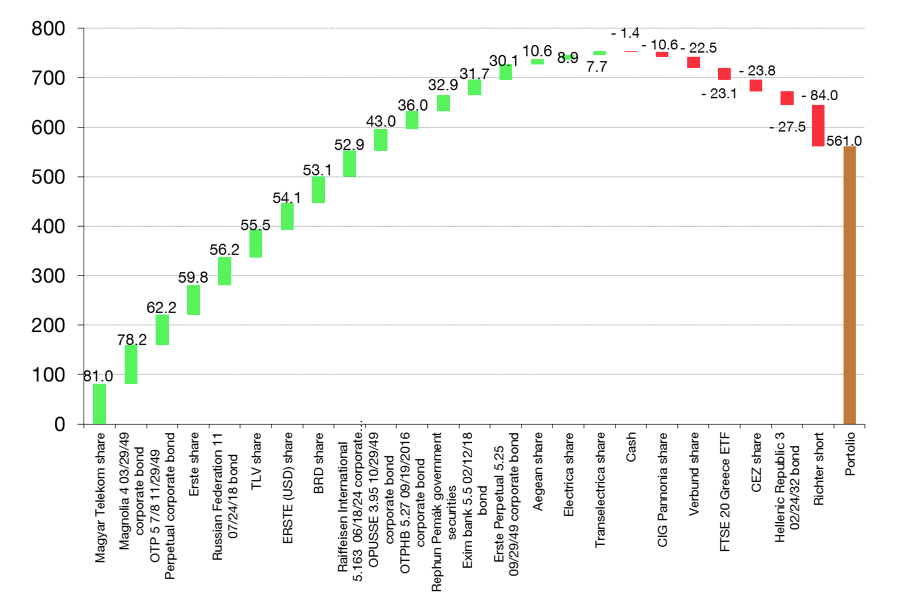

2. A breakdown of the 2015 performance of our recommended private banking portfolio

(Contribution of specific instruments to the return, in basis points)

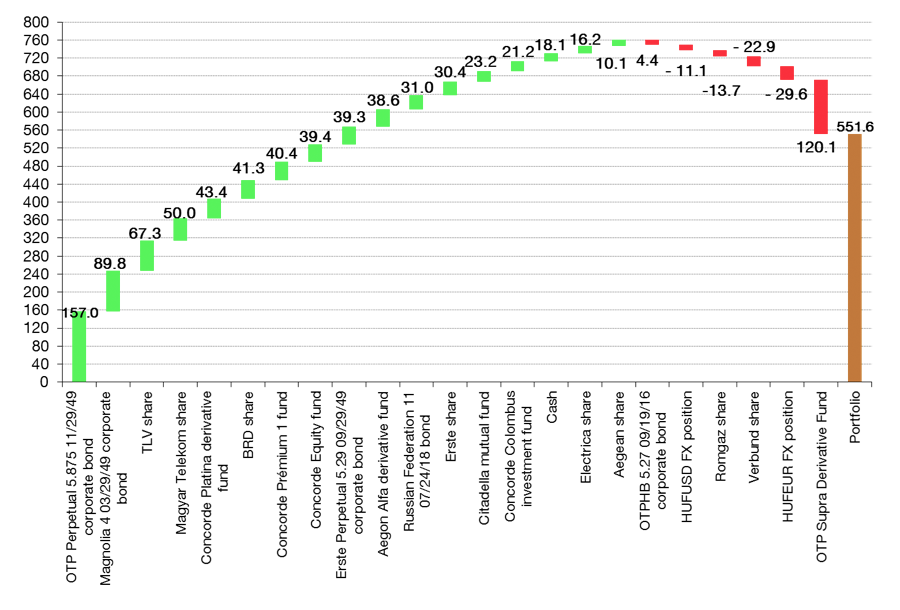

3. A breakdown of the 2015 performance of our recommended euro-denominated absolute return portfolio

(Contribution of specific instruments to the return, in basis points)